What you should do now to combat demonetization.

- The aftermath of the Corona crisis threatens permanently low interest rates and increasing currency devaluation

- With the right tactics, old-age provision and asset accumulation can still succeed

- Get professional advice to find the right pension solutions for you, even in times of low interest rates and rising inflation.

Savers will lose out. They now need a strategy with which they can increase their money despite low or even negative interest rates.

- At the beginning of the year, the value-added tax was raised back to normal. This and the oil price recovery are driving inflation in 2021.

- The CO2 tax introduced this year is making oil and gas more expensive.

- In the long term, demographic change with a growing number of retirees could also fuel inflation. "As retirees continue to consume but no longer produce, shrinking supply meets stagnant or even rising demand: these are definitely the ingredients for rising inflationary pressures," explains Martin Moryson, Chief European Economist at DWS.

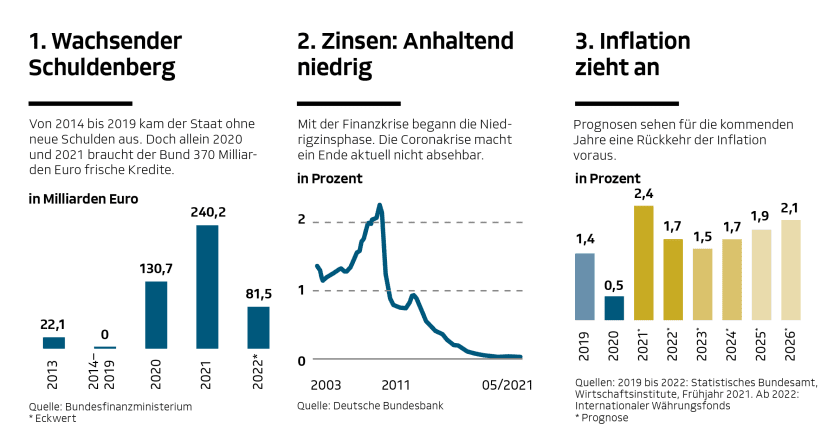

1. Growing mountain of debt - from 2014 to 2019 the state got by without incurring any new debt. Yet in 2020 and 2021 alone, the federal government will need 370 billion euros in new loans. Values in billion Euros

2. Interest rates: Persistently low - the financial crisis marked the beginning of the low-interest phase. The corona crisis means there is currently no end in sight. Values in percent.

3. Inflation picks up - Forecasts predict a return of inflation in the coming years. Values in percent.

Interest rate defaults and rising inflationary pressure are making life difficult for savers and investors. Wealth advisors help you counter these developments with the strategy that suits you best, so that you can make the smart financial planning choices and successfully defy low interest rates and inflation.

Owning your own real estate is a tangible asset that can often survive a drop in the value of money. The real estate boom has been going on for ten years in many parts of Germany. At the same time, however, interest rates have continued to fall, keeping real estate loans affordable for many eligible German residents and citizens.

- If you want to build or buy a property now, you can currently get financing at affordable rates.

- Due to the current rapid increase in construction costs, make sure that you have a firm commitment on prices. Due to the shortage of building materials in some segments, you should also firmly agree on delivery dates so that there are no delays in the construction phase.

- Tip: With our partner FingerHaus, for example, you receive a 24-month price guarantee and a fixed delivery date for your house.

- If the purchase or construction of your own four walls is not planned for several years: With a building savings contract, property owners-to-be can secure the favourable interest rates for later financing at today's market rates.

- Apart from a one-time payment, gold can also be purchased with smaller regular amounts as a savings plan.

- The precious metal can be integrated into private old-age provision - for example with an asset-oriented pension insurance.

- With the gold savings plan (GEIGER GOLDSPARPLAN) from as little as 25 euros per month, you can acquire physical gold. Alternatively, gold bars can be purchased with a one-time payment.

You can only maintain at least the purchasing power of the funds you have invested if the return on a savings or investment solution is higher than the rate of inflation. Solutions that rely solely on interest rates - which are currently low - do not succeed in compensating for inflation. But there are alternatives for financial planning and asset accumulation.

- Retirement planning: With the state-subsidised forms of Riester or Basic Pension, tax breaks and/or subsidies make for an attractive return.

- Asset development: With investment funds, investors can take advantage of the return opportunities offered by the stock market and beat both inflation and low interest rates. It is true that stock market prices tend to fluctuate from time to time, so it is wise to spread your money widely, funds can minimise this price risk.

- There are two options: investing a larger amount once or building up assets through a fund savings plan with continual smaller contributions.

Get your finances in order!

Get an overview right at the beginning of the year. I am happy to help you.